Interview With A Business Woman of Extraordinary Warmth

by Bill Singleton, Jr.

SINGLETON: You cannot do everything.

LEWIS: That’s again one of the lessons Mr. Lewis learned. He was his own lawyer, his own accountant, his own engineer, his own and on and on, and he failed. Because then he was doing it all, OK? He is the creative mind. So he needs people to support him so that he can push forward, you know, [it’s like a chip?], you know you —

SINGLETON: How did he do it?

LEWIS: OK, well he, you know, selecting people. OK? So he was able to select a good law firm, you know, an investment banker, and all the rest. And they voted him in as chairman, of course, because if it failed, then he would be bankrupt. Because he had to pay them all. But, they believed in him. They stick with him until he got the thing accomplished. They stuck with him until he finished accomplishing his goal. So he failed and he was trying to buy companies because he was, his own investment banker, his own lawyer, his own accountant, so nobody was, was interested, he had to tie in their interests to his. So, as I said, when he finally found the right company to buy, he hired all of this, so that if he failed, then they don’t get paid, or they get paid very little. You know. So their interests are tied to his. And therefore they must see to it that he succeed, that he gets the deal.

SINGLETON: Well when he started, who gave him his first really big break? You know, when you first start you need the capital —

LEWIS: Yes, you need capital. He was working as a successful lawyer for 15 years.

SINGLETON: For 15 years?

LEWIS: Yes, and when he had made enough money, he was able to find this deal, the [Whole Pattern?] company. He went to his bank, Morgan, where he had been banking since he started his law firm. Every year he would come to his banker and say “all right, my goal for this coming year is this. Last year my goal was this, For this coming year, this is my goal.” So every year he would go there, and this banker would know that he’s, you know —

SINGLETON: He set these goals successfully.

LEWIS: He’s, he has always been whatever he said he, he achieve if not more. So after 15 years of doing that, he came and said I need $500,000 as a loan. I’ll pay you back in 30 days. OK? So this banker, you know, had seen how he was going up, OK?

SINGLETON: And he was doing investment banking at that time?

LEWIS: No, no, no, no. He was just practicing lawyer.

SINGLETON: Just practicing law.

LEWIS: You know, you practice law, you get fees, you know. You increase your clientele; you get more fees. Increase your clientele you get more and more fees. So his law firm was growing, OK? So —

SINGLETON: This is this is Lewis & Clark, right?

LEWIS: Lewis & Clark, Lewis & Clark.

SINGLETON: Is that like the explorers?

LEWIS: Yes, exactly. They were explorers. They were —

SINGLETON: Something about tender loving care, there, that’s Lewis & Clark, it looks like the explorer to me, I know something of history….

LEWIS: Yes. I call it tender loving care, but it was, it was the Lewis Companies. It was the Lewis companies. So, when he was ready to do the deal, you know, even as a lawyer, you don’t accumulate $500,000. We have a home, we have a foreign car, we have a vacation home, but $500,000, you don’t find that cash.

SINGLETON: It is difficult.

LEWIS: So, the bank looked at his track record, looked at, yeah, that this guy has integrity, ask around, and they could not hear anything that, oh, this guy is a shyster, this guy is sleazy, no. Nothing but good words. We think this guy has integrity. What he says, he delivers. So they gave him a loan.

SINGLETON: They gave him 500,000?

LEWIS: On character. No collateral. $500,000. And that’s how he bought McCall pattern company. 100% borrowed money.

SINGLETON: Well McCall was only 500,000 at the time?

LEWIS: No, 22 million.

SINGLETON: So he put down the 500,000 as the base?

LEWIS: OK, they needed one million from him. So he borrowed 500,000 from McCall, from, from Morgan Bank, and he borrowed another 500,000 from MESBIC (Minority Enterprise for Business), OK, from MESBIC. Very high interest. I think something like 24%. That’s usury rates, I mean.

LEWIS: It is, it is, yeah, well that’s the way, you know, you need the money —

SINGLETON: I hope he never made a deal like that again. [LAUGHTER]

LEWIS: He bought it out. Easy. He bought it out.

SINGLETON: Really?

LEWIS: Yeah. He bought it out.

SINGLETON: When was this going on, I mean, like for 15 years, you said he started like —

LEWIS: As a law firm.

SINGLETON: What kind?

LEWIS: Corporate. Corporate law.

SINGLETON: About what, what —

LEWIS: Oh, 1972. OK? In 1984, so how much is that? 12 years. 12 years, not 15. 1984 he bought McCall Pattern Company.

SINGLETON: That’s pretty fast.

LEWIS: So on borrowed money, he bought one million on his own, which is all borrowed, and then the rest we borrowed from the bank. Why? Because he analyzed that McCall Pattern had enough cash flow to pay a debt of 22 million. OK? And that’s exactly what happened. So, there was a debt of 22 million. If your earnings keep on going up, you know, your equity or your value keeps going up.

SINGLETON: Right. He discussed in the book about cash flow.

LEWIS: Yes.

SINGLETON: Because one of the people was trying to say to him, “well, you don’t understand, and this isn’t the business…”

LEWIS: Yes, yes.

SINGLETON: And he kept saying no, the key to this is cash flow.

LEWIS: Right, right.

SINGLETON: I was just wondering what were some of the attitudes that he had to deal with? I started a business and had had to deal with people’s disbeliefs. When you start out, everyone thinks you’re going to fail, you know, and, to be honest with you, you’re working so hard that you don’t know what people are saying about you. How do you think he dealt with that?

LEWIS: Don’t even listen. Don’t listen.

SINGLETON: I try not to, but I always worry that I’m not going to be able to do what I said I was going to do. You know this is in my mind. I wake up in the morning saying “I’m sure that we can accomplish it and it just takes a long time.” But in that period, you know, people are nay-saying and communicating attitudes, where they do not want to be as cooperative. And I’m wondering how he dealt with that, like say at McCall.

LEWIS: Well, he paid it no mind. He set his goal, OK? He knew exactly what he was going to do with McCall. I mean, he didn’t buy it and say “now what do I do now?” No. He had a plan. He is going to increase the earnings, OK? And in the three years that he ran it, it had the highest earnings.

SINGLETON: [UNINTEL PHRASE] Ninety million or something, right?

LEWIS: He had the highest earnings, meaning to say the net income rose to its highest level in the 115-year history of McCall pattern. So, how do you get earnings? You communicate the message that “I want earnings” all the way down the troop. I want earnings.

SINGLETON: I want earnings.

LEWIS: Right, OK? So you send that message all the way down the troops and just put your foot on the petal so that they produce.

SINGLETON: I read that.

LEWIS: OK?

SINGLETON: He said, he said 25% of the people probably need a good swift kick in the keister to get them moving, you know. But how do you do it without turning them off?

LEWIS: No, well, that’s tough.

SINGLETON: But sometimes you have to.

LEWIS: Right now, I am running the company, and I am the cheerleader. I, I try to inspire them that they can do it. You can do it. I mean, of course, all of my managers, and I am so lucky that Mr. Lewis bought Beatrice. Because of all of his managers.

SINGLETON: He’s my first story, you know.

LEWIS: Huh?

SINGLETON: He was my first story.

LEWIS: Oh really?

SINGLETON: I met him in 89.

LEWIS: Oh. At Harvard Law?

SINGLETON: Yeah. He was giving a talk there that night. And I said I’ve got to get him the magazine.

LEWIS: Oh really?

SINGLETON: In Black History magazine. I said I’ve got to get this story. And so Butch Miley and some other people sent me a media kit, and I put some people on it.

LEWIS: Really?

SINGLETON: I call that issue the pass over an issue. We had to pass over every mistake in the magazine to get it out on time. Someone had stolen $10,000 from us, and we didn’t —

LEWIS: Huh?

SINGLETON: Yes, the guy was supposed to do the work. He didn’t do it.

LEWIS: And you paid him?

SINGLETON: Yes, I paid him $10,000. So I took what I could, but I couldn’t afford, at that time, new computers weren’t as powerful as they are now, and I couldn’t afford to make all the upgrades that we needed. So I said we’ve got to, we’ve got to get that idea out here. We were the first black history magazine in the country.

LEWIS: Wonderful.

SINGLETON: Went out to NAACP convention in California in 1990 and sold, I think a thousand and two hundred of them at $5 a magazine.

LEWIS: Wonderful.

SINGLETON: He was my first, one of my first stories.

LEWIS: Wonderful, oh really?

SINGLETON: Yeah.

LEWIS: You sent him a copy?

SINGLETON: Oh yes, I sent him a copy a while back, a long time ago. But at that time, who knew what the magazine was? No one knew, you know, he, he probably, I don’t know if he even got to see it because maybe other people handled his mail. And I’m sure he gets a lot of it. So I’m not certain if he saw it. We were trying to do as best we could with what we had, but it was a very rough go, and it still is, but it was, at that time, no one believed us, and we had to sell the magazines at $5 a magazine, so people were already going, “wait a minute,” you know, and we, my sister and I went out there to make it a success. I would go to all these organizations and stand in the lobby and sell the magazine.

LEWIS: Wonderful. [UNINTEL PHRASE]

SINGLETON: It was like, I was like, I’ve got to get this money back and, and make this profitable.

LEWIS: Right.

SINGLETON: And I was focused on that. Wait a minute I’m interviewing you. You talk about earnings, that was —

LEWIS: Very good, very good. No, no. That’s good. He would love that.

SINGLETON: You know, I was going to ask these questions that I had jotted down, but I’m having a great time just talking to you. You mentioned that when he started out, he had to have the perseverance to go on. Some of the characteristics like being tough, smart, generous, and kind, are actions he had to commit to in his life. But who influenced his thinking? I know the one person did get him to change his career goals. I think he was interested in football, and he changed it to business management. But who are some of the other people that you know of that changed his thinking about what he wanted to do?

LEWIS: Well not change. Because he had formed this thinking in his childhood. I think that his family, his mother, and father influenced him. His grandparents. His grandmother and grandfather. And then all the uncles and aunts, because they always talk about achievement, people working, you know, and the value of hard work. You know? The value of, what do you call this now, learning your stuff, you know. It’s individual. Know your stuff and don’t take any crap.

SINGLETON: Yes, I can identify with that expression.

LEWIS: You know? You have to have the drive. You know, much like what you’re doing. OK, this is my goal, and then he does everything to reach that goal. You know, when he was an athlete, he wanted to play baseball when he was young. Every afternoon, just hitting the ball. The ball is tied to the tree, just hitting it and hitting it and hitting it. Now, and he became a football player —

SINGLETON: He was a football player?

LEWIS: Quarterback. For the high school in Dunbar. OK? Practicing, hip, hip, hoops, I mean, you know, just constantly practicing and practicing, practicing, practicing. I mean, so his life didn’t start with McCall Patterns. In his childhood, he learned the habit of working hard and winning. It’s not working hard and then failing, no, no. Working hard and winning–

SINGLETON: But what do you do when you get some failures —

LEWIS: Oh he just –Brushes it off. And then he studied, what am I doing wrong? And looking at the successful guys. What are they doing right?

SINGLETON: Well do you know of any other lessons he learned?

LEWIS: Hiring the right people, identifying the right people to help you go to success.

SINGLETON: Do you remember any one particular failure that he had to use what he had learned —

LEWIS: Oh, a lot. A lot, a lot. I mean, you know, for just the business, just, OK, first he was a very successful lawyer, But, invariably, the CEO of a major company would be changed. And they’ll ask him, after working for five years for this company as a special counsel, Lewis & Clark, they would say send us your resume. OK? So back to zero.

SINGLETON: That’s real, I know what that is.

LEWIS: So it’s very, you know, that’s terrible.

SINGLETON: Yeah, they wanted, they didn’t, yeah.

LEWIS: You know, they, they, they would not look at all the five years of good legal work they had done. Back to zero. A glass ceiling. That’s what he said. I need to go on my own, OK? Then the sky is the limit. But not start from zero. He knew better. Acquire a company.

SINGLETON: Acquire a company.

LEWIS: Acquire a company. Turn it around, sell it. Acquire another one. Turn it around, sell it. Not turn it around. But just work it —

SINGLETON: Grow it.

LEWIS: LBOs.

SINGLETON: LBOs? Leveraged buy-outs.

LEWIS: Leveraged buy-outs. His exam, no, his honors grade at Harvard Law school was merger and acquisition under the best lawyers, Louis Loss.

SINGLETON: Louis Loss?

LEWIS: The best professor in securities, Louis Loss.

SINGLETON: Louis Loss, OK.

LEWIS: You know, so he learned. He learned also. He’s absorbing, constantly learning.

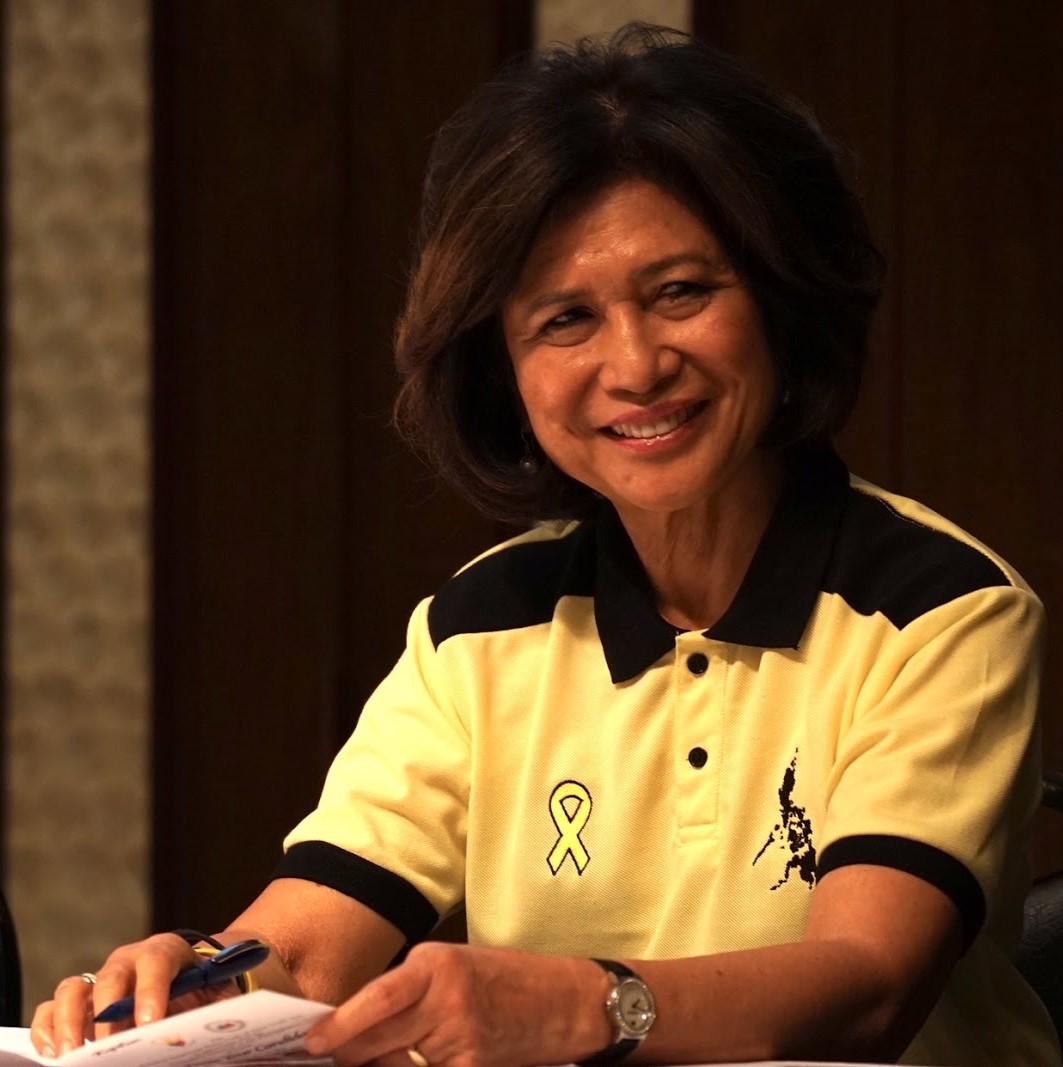

SINGLETON: How did you meet him? I mean, you’re a lawyer, for those listeners and readers that we are going to invite into our pages here and, you, how did you meet him? When did you meet him, like in the 70s? Or?

LEWIS: 1968. 1968. I just passed the bar. I was sent on around the world trip by my father because I just passed the bar, my father himself was an entrepreneur.

SINGLETON: What did he do?

LEWIS: He was a businessman. We have a furniture company in the Philippines. But his real dream was to be a lawyer. But he was poor, so when he went into business, he couldn’t go back to law school. So when he saw me growing up very talkative, very ambitious, very outgoing, you will be the lawyer. We were five in the family. You will be the lawyer. OK? So, I became the lawyer, and I passed the bar. He was so happy. He sent me on around the world trip with my mother. My sister was in New York.

SINGLETON: What was she doing?

LEWIS: She was studying at the —

SINGLETON: Studying law too?

LEWIS: No, no, no, masters of art in, masters of art history, in Columbia University. So I said I’ll pick up my sister and then all together we’ll go to Europe and then back to the Philippines and I will be my father’s lawyer in his business. Go to politics, become a congressman from our province, governor, maybe senator.

SINGLETON: Were you there during the, I guess the change in?

LEWIS: No, this was in 1968. I’m much older than you would think.

SINGLETON: My god, you seemed pretty young to me.

SINGLETON: 1968, and, yes, yes.

SINGLETON: Well we won’t…

LEWIS: No, no, no, I’m not, you know, they, it’s printed in our 10Q, the —

So, when my sister was going out on a date, the truth of the matter is that I’m waiting for my sister, and I was not doing anything. I said I’m going to work as a secretary, so I went to a legal, civil rights organization and my boss met my sister, and they started dating. So he said, how about Loida, I’ll fix her up on a date. Called up Reginald Lewis, he was —

SINGLETON: How did he know Reginald Lewis?

LEWIS: They were classmates at Harvard Law School.

SINGLETON: Oh, OK, and he was, this fellow was working as a —

LEWIS: He was the director of the civil rights research [OVERLAPPING VOICES]. A non-profit, so Reginald, Reg Lewis said no, I’m too busy. Oh, you know, that’s too bad. You know she comes from the Philippines. And reg sort of say, wait a minute. I have never dated anybody from Asia before. OK, I’m coming. You see. Always, Always ready for new things. You know, his mind wasn’t closed. You know, hmm, from Asia, oh, maybe I’ll learn something. And that’s how we met. Blind date.

SINGLETON: How did he pop the question?

LEWIS: He was very, he was very –He was always — It was exhilarating. Exhilarating because, you know, non-stop, we talked non-stop. I mean, he had many things to say, I had many things to say, two different cultures. You know.

SINGLETON: Did he ever go to the Philippines?

LEWIS: Later. So, when we went out on a second date, he became fresh. So I wrote him, I don’t want to see you again. What? He came back. So I was intrigued. I said, didn’t I told you I don’t want to see you again? And Loida, you don’t have to do anything you don’t want to do. Oh. [LAUGHTER]

SINGLETON: [LAUGHTER] Sly, sly, sly.

LEWIS: Very smart, very smart. He knew he knew the woman he was confronted with. And then I was falling in love with him. And I said I can’t. I’m going back to the Philippines. I said I am going to be, you know, my father’s company lawyer, I am going into politics. And if I fall in love with this guy, I might get married here, and this is not my place. I said I don’t want to see you again. So three times.

SINGLETON: Three times he asked you?

LEWIS: Three times I said, I don’t want to see you again. So the last time we said goodbye —

SINGLETON: Now aren’t you glad you did?

LEWIS: The last time I left, I left for the Philippines. And we said goodbye, but on the way, I was just in California, San Francisco, Palo Alto actually. In the university of Stanford. I was so sad. Because I knew I would not meet somebody like him again.

SINGLETON: What did you like about him? What struck you personally?

LEWIS: He was, I am a very, very strong woman. But —

SINGLETON: Yes. We see. I like that.

LEWIS: But he was the first one who was able to catch my attention, keep me, you know, sort of like, keep me quiet. OK? It is terrible, and feminists won’t like this —

SINGLETON: Yes.

LEWIS: But, it’s like —

MILEY: Yes, I’m glad we met again after all these years.

SINGLETON: Same here.

LEWIS: And you’re one of the few who met Mr. Lewis [OVERLAPPING VOICES]

MILEY: Way back when.

SINGLETON: So finish telling me about how you met, you were in Palo, you were in California and —

LEWIS: I was in California, and I knew I’d never see him again, and I was so blue. Everything was gray.

SINGLETON: Did you call him?

LEWIS: I called him. I said, darling, I’m coming back. So the third one we [UNINTEL], it’s not quite right that he, three times [OVERLAPPING VOICES] I was the one. I was the one.

SINGLETON: But that was good though, I mean, it showed, you really loved him, and that he really loved you.

LEWIS: Well, you know, I, the thing is, that you know, I, you follow your heart, you know. When I knew. I went to the best school in the Philippines –I learned from the best minds, with the best men and women. So I know when I meet somebody —

SINGLETON: It must have been tough there too because of the political situation there.

LEWIS: Well, in ‘68 there was, it was martial law, OK? So, so I know, I know when I meet my match. So he said all right, don’t come back here. Go back to the Philippines. And talk to your family.

SINGLETON: So what did both families say?

LEWIS: Well, I met his family. That’s why I knew it was all good. I met his family, and they were like a Filipino family. Cooper, the grandparents, OK, the grandparents, his uncles and aunts and the Fugetts, which is the stepfather and his brothers and sisters. They are half, but he doesn’t call them half-brothers and sisters. They were brothers –And they much like Filipino family. Very close to each other, very warm, very spiritual. They were Catholic, you know. So it was all there. There was no, you know, as I said, my parents never really raised us to look at people, oh, he’s poor, he’s rich, oh, he is black, he is white. No. That was not our training. So, and my father, I’m the eldest daughter. There are two boys. I’m the eldest daughter.

SINGLETON: How many people total?

LEWIS: Five. Five brothers and sisters.

SINGLETON: Big family.

LEWIS: Yes. And my father knows that he knew that I’m not flighty. I am not, you know when I say this is the man, he must be somebody. OK? So they didn’t take any position, I was of age. I’d finished law. I’m 26 years old then.

SINGLETON: And he was a lawyer.

LEWIS: He was a lawyer. He was graduated from Harvard. He was working in a law firm. He could definitely, afford a wife.

SINGLETON: When did he I want to buy one of these companies? Were you there for that or?

LEWIS: Well the first year of our marriage, he would, we lived in a five-story walk-up, small apartment.

SINGLETON: Where was this? In New York?

LEWIS: In New York, in Chelsea. And at the end is the bathroom. He would take long showers. And at the end of that he would come out, “I’m at one million, Loida?” One million. A few months later, he would come out; I’m at five million. I’m at five million Loida.

SINGLETON: But did have a million yet?

LEWIS: No, no, no. He was just; he’s taking a shower. He’s thinking it up, how to, how to create wealth, how to get rich. And then, in the end, until we moved to another apartment he was at 11 million. 11 million dollars. [OVERLAPPING VOICES]

SINGLETON: 11 million, how did he come to 11?

LEWIS: That’s what he was thinking, the leveraged buy-out. Buying companies. Buying companies. Because his master’s thesis is mergers and acquisitions at Harvard Law School, so from day one he knew to create real wealth, you do mergers and acquisitions. OK? So, from the very start, he knew to create wealth you buy your company. So when he was saying, I’m up to ten million, that’s what he was thinking. Buying companies, working them, selling them. So, that’s the only way, you know. So you, you parcel it out, you leverage it out. He was at 13 million by the time we moved to another apartment. And then I didn’t hear any more. So what am I saying? When did he, your question was, when did he buy his first leveraged buy-out, OK? He tried three times and failed. And it’s only the fourth time that he succeeded in buying McCall Pattern Company.

SINGLETON: Two times before this?

LEWIS: Three times he failed, to buy sausage company, a, a station, radio stations, a group of radio stations, and then a furniture company, you know, all failed.

SINGLETON: Well the furniture, company.

LEWIS: Huh?

SINGLETON: That would be in the family line.

LEWIS: No, this was in California.

SINGLETON: Why did he fail? What were the reasons?

LEWIS: The reasons, OK. After he failed the third time, it was really a great shock. He was almost close to a nervous breakdown. He said, there must be something I’m doing wrong. So, unlike other people oh, because they are racist, it’s your fault, I mean. You know, you point to everybody. He had the humility to think; I must be doing something wrong —

SINGLETON: That’s how I feel.

LEWIS: I’m not ready yet —

SINGLETON: Yeah, I had that same feeling.

LEWIS: There is something I am not doing right. And so he said what are the other people who are successful, how did they do it? And that’s what they [told you?]. When he understood, he was doing it all himself, and he has to hire the right people, OK? The right law firm, the right accountant, the right, um, lawyers, you know, to help him push the deal.

SINGLETON: How do you find “the right people?” You see I have people that work with me, and sometimes they stick and sometimes they don’t.

LEWIS: Then you let them go. Those who cannot go with your style, they’ve got to go. They’ve got to go. You’ve just to be completely focused. OK?

SINGLETON: And you just measure it according to what you feel is —

LEWIS: Performance. Performance is key. I mean, you are not a non-profit organization. The Even non-profit organization, if they are not run efficiently, will not, will not succeed.

SINGLETON: They won’t succeed, no. You need to be focused on the cash flow.

LEWIS: Right. And also if you are paying these hangers-on who are not paying their way, you’re not doing them a favor. They are getting something for something that they have not worked on and it’s bad philosophy. You’re not helping them, OK?

SINGLETON: So just cut them off if they’re not producing?

LEWIS: Cut them out. If they’re not producing, cut them out.

SINGLETON: Three month period? Or? How much time do you give them?

LEWIS: No, I don’t give them any time. I give them, usually because the company is good, I give them three months with pay, but at that time I did it to secretaries. I’m sorry, it’s not working out. You leave today. You have three months. For the next three months, you’d receive a salary, but you leave today. Why? Because if you let them stay on, there is, you know, why did she fire me, no no. She will not produce for the next three months. You know? So, just decide what is just, to let her go.

SINGLETON: Do you have a printed, sort of standards or is it?

LEWIS: Huh? Well, it, there was, in, in the TLC Beatrice, yeah. Before they come in, you should have, decide the rules. Ta ta ta, ta ta, OK? Six months, you know, you should have a six month or three months preparatory or, temporary, I can’t remember what the word is? Provisional.

SINGLETON: OK, provisional.

LEWIS: OK, we [didn’t say?] six months or three months, you decide whether they fit or not. If they don’t fit, then two weeks free pay or one week free, you know, one week pay, but after that, then they become regular. So if I still have to fire them, then I give them one month.

SINGLETON: But, but you keep it, you keep it pretty much close to the vest.

LEWIS: Yes, yes, yes.

SINGLETON: This deal with TLC, I want to get to that —

LEWIS: With Beatrice?

SINGLETON: Yes, with Beatrice. Now that deal was done with Mr. Milken’s help. I read in the book that he needed Mr. Milken to gain…

LEWIS: Credibility, credibility.

SINGLETON: Right, credibility.

LEWIS: So it is an auction, OK? It’s an auction.

SINGLETON: And Kravitz [SP?] —

LEWIS: Henry Kravitz was selling the international portion of the Beatrice Companies. He bought it in a leveraged buy-out. We had Henry Kravitz, OK? I’ve met him a few times, socially. He’s a very nice guy.

SINGLETON: Yes.

LEWIS: But for his business, it’s put up, or you shut up, OK? When Mr. Lewis made the bid, his was the highest bid. He overbid Citibank, Au Bon Pain [SP?] which is a French company, Restore [SP?] which is a well-known LBO company. He had the highest bid. So when the opened the envelope, and they said, TLC Group, what on earth [UNINTEL PHRASE] who the hell is this guy? OK? And so that’s when Mr. Milken came in. He said I know them. They have credibility with me. And Mike Milken at that time was raising millions.

SINGLETON: He really opened a lot of doors for black business men and others.

LEWIS: If he says to his company that they will have great money, he can raise it. So, because of that, Henry Kravitz took in the bid of TLC Group. And that’s why they were awarded the contract to buy, OK? From August, the signing of the contract, to December. That’s four months, OK? During the four months he knew, Mr. Lewis knew, that for $1 billion, if you borrow all of that money, you would be dead in the water, just paying interest. The key is to reduce that debt. So, within those four months, instead of raising and, he had the companies, he started selling them even before he owned them, he sold Australia. He sold South America. He sold the [UNINTEL] company in Spain. He sold Canada, OK? And by doing that on the day of closing, he closed all of his other deals, so immediately he paid off $500 million. So he only had to borrow the other half.

SINGLETON: Right, right, right.

LEWIS: OK? And that’s what Mike Milken raised.

SINGLETON: How much did he have to [bring?] before he sold that off?

LEWIS: How much money, cash?

SINGLETON: Mm hm.

LEWIS: How much cash? They wanted from him 15 million.

SINGLETON: 15, OK. To start the deal.

LEWIS: To start the deal. 15 million, well, to put your own money in. But at that time he sold McCall Patterns, so he had something.

SINGLETON: Yeah, cause it was 90 million.

LEWIS: 90 million.

SINGLETON: Yeah, about 90 million.

LEWIS: So he had plenty of cash. He paid Uncle Sam half of it.

SINGLETON: There, I don’t know about them being partners now. Now, what are you doing today? I know that there were a couple of things that went on that you’re doing. So why don’t you just bring us up to date as to what you guys are doing now?

LEWIS: Yeah. I have finally got the company to the size that I wanted it. We are now [eight?] companies, OK? Divided into two segments, for distribution supermarkets and groceries, which is manufacturing.

SINGLETON: These are the Hyper-markets in France?

LEWIS: Yes, supermarkets. It’s not the hyper market, just supermarket, regular supermarket. Meaning that’s not huge. And, uh, in Paris. And all over France. We have two names. One is Grand Prix, this is the supermarket in Paris, and Leader Price [SP?] which are supermarkets all over France. But it’s a special kind of supermarket because when you go in, there is no Coca-Cola, no Ritz, no, uh, Tropicana, there’s only one brand. Leader Price brand. But, you bite into the crackers, it tastes like Ritz. You drink the Leader Price cola, tastes like Coca-Cola, you know. You drink the orange juice; it tastes like Tropicana. But the name is Leader Price, and it’s 30% cheaper.

SINGLETON: Yeah, that’s a good…

LEWIS: Yeah, so, so —

SINGLETON: That’s great. Is that where the basis of the company is?

LEWIS: That is my growing, the growing part of the company, and that’s what I intend to grow, to spread to all over Europe. I’m starting with Belgium and Spain.

SINGLETON: What do you, I mean, besides the company, what are some of your personal things? Are you considering writing, because you know, you’d be great at —

LEWIS: I have no time.

SINGLETON: You, you would make a, it would be interesting to do your own book, I would think.

LEWIS: No, somebody else will have to write it for me.

SINGLETON: Really?

LEWIS: It’s too, it’s too, it’s too intimate and too painful to write.

SINGLETON: Really? Oh man, that would be interesting to do a book. I think that would be very good. I think people would want to know about this.

LEWIS: I’m not finished yet. When I’m 85 —

SINGLETON: Ah, please. You’ve got a lot of time before that Now, the role for your, your daughters, in the future. What, what do you see for them? Do they, do they want to continue in this business?

LEWIS: OK, Mr. Lewis had always raised, We have always raised our daughters to be principals, meaning to say, be the best that they can be in something that they enjoy doing. But as principals, because that’s how he, that’s why he created this so that they had choices.

SINGLETON: Right.

LEWIS: Of course they can be actresses. But they can own the movie company.

SINGLETON: That’s right.

LEWIS: OK?

SINGLETON: I felt the same thing, you said, go ahead, have your own. Get your own.

LEWIS: Right OK? They can be doctors, but they can own the hospital, OK? So what I’m saying is that what [UNINTEL] did he raise them so that they can take over the company? If that’s what they want, of course, but, it’s not like they are dying, you must succeed. No. I’m not running this company so that Leslie has to succeed me. No, I’m running the company so that it’s [become?] successful. If at a certain point, I don’t want to do it anymore, if she’s available that’s fine, but if she’s not, it’s fine too.

SINGLETON: Has she indicated that she wants to?

LEWIS: No, she doesn’t want to. She wants to do her own thing.

SINGLETON: What’s her own thing?

LEWIS: Doing film.

SINGLETON: I know that’s the [rage?] [OVERLAPPING VOICES]

LEWIS: Yeah, doing film.

SINGLETON: I want to do film too. That is the best job in the world, I think. People really love doing it. Um, there is a fellow that was on the It’s a different World show. His father had an investment firm too, and his father died, but his father didn’t put it in trust, I don’t think. It would have been better I think if he had put this company in trust because it was in his interest, you know, to do this, and I think that some problems came up, I’m not sure of the particulars, but you know, that that is one way of avoiding those problems, is to put it in trust. If they don’t want to do that, if they’re interested in doing it, if the children’s interest is in creative arts or something then they can continue getting income from the company in the form of a trust., anyway, I don’t want to bore you with that. Now he gave five million; he gave some money to Harvard —

LEWIS: Three million.

SINGLETON: Yeah, three million.

LEWIS: Harvard Law School. The highest contribution that an individual had given Harvard Law School. So again, he’s cutting edge. And he’s the first one.

SINGLETON: The highest?

LEWIS: One individual in 1992 who gave three million. Who pledged. He didn’t give it outright.

SINGLETON: Ok.

LEWIS: He pledged three million. And that’s the first person who gave that much, OK? So, again, cutting edge. The first one. Of course, after that Harvard Law School could easily tell somebody, hey, Reg Lewis gave three million, why don’t you give five? You know, but he was the first one who put his money where his mouth is.

SINGLETON: Well now, to Spellman, to the, you know, cause, you know, the criticism is, well, what did he do for the black colleges and things? I mean?

LEWIS: He gave $1 million to Howard University. And he did not even graduate from there. OK?

SINGLETON: But he did graduate from…

LEWIS: Virginia State.

SINGLETON: Right, right.

LEWIS: He graduated from Harvard Law School.

SINGLETON: Harvard Law School, that’s [UNINTEL PHRASE].

LEWIS: But undergraduate is Virginia State. So, that, he gave one million, Howard University. Why? Because it’s the premier African-American university. And he wanted to show his support. And he has given —

SINGLETON: Many to others.

LEWIS: Another ten million to mostly African-American education, and artistic, you know, social organizations.

SINGLETON: That’s good, I mean, he showed himself to be a leader and, I can’t even think of any other black, Except Bill —

LEWIS: Except Bill Cosby.

SINGLETON: Yeah. Yeah, Bill Cosby has.

LEWIS: Bill Cosby gave 20 million to Spelman College.

SINGLETON: Oh, I didn’t know that.

LEWIS: He did. Twenty million. They have, there is a building, there is a building there named after his wife.

SINGLETON: Did he pledge it or he gave it outright?

LEWIS: He gave it outright, [and?] the building is finished.

SINGLETON: How do you deal with the racism and the jealousy that came with this business? I mean, there are issues there. What could you give as advice from what you’ve seen and how you’ve dealt with those?

LEWIS: Pay this no mind.

SINGLETON: Pay it no mind.

LEWIS: Pay it no mind. If you start listening to nay-sayers and people with negative things, oh, he’s black, oh, he is this, or he is that you’ll never get anywhere. OK, eye on the goal. Eye on the goal —

SINGLETON: Eye on the goal.

LEWIS: And once you start listening to these people, you really will get bogged down. So what you do is to stop yourself. If anybody around you is a negative thinker, don’t deal with that. Separate yourself from them. You know. Hopefully, it’s not your wife, or —

SINGLETON: Oh, no, no.

LEWIS: Or close to your friend because then it’s, then it’s too close, and then you just grin and bear it. But surround yourself with people who are positive —

SINGLETON: Who are very positive.

LEWIS: — thinkers, you know.

SINGLETON: What do think is the legacy that he’s left behind? I mean the legacy that will be emblematic of people that want to come after him. Because I know, I remember when you told me a while back that this one fellow, we won’t mention names, was kind of upset that he, you know, this guy had succeeded beyond him. And that’s not what, what you said is important. Of course, you’re supposed to go beyond the benchmark. I mean, this is the nature of growing, you know. What do you think the legacy he’s left behind?

LEWIS: I think the legacy is one of hope, that if you are willing to work hard and dare to dream, you can reach it?].

SINGLETON: Yeah.

LEWIS: And, and that’s a legacy for people black and white.

SINGLETON: Anyone, anyone.

LEWIS: So it’s the hard work, it’s the vision and the determination. Don’t let anybody stop you. You know. But you must also, you know, you must also be able to know what you’re doing wrong. You know, you cannot bang your head and bang your head on the wall. That’s what, that’s basically his legacy. It can be done.

SINGLETON: It can be done.

LEWIS: It can be done.